First Time Home Buyer Colorado Grant

Table of Content

Department of Agriculture through the USDA Rural Development Guaranteed Housing Loan Program. Applicants with credit scores of 640 or higher receive streamlined processing. Those with scores below that must meet more stringent underwriting standards.

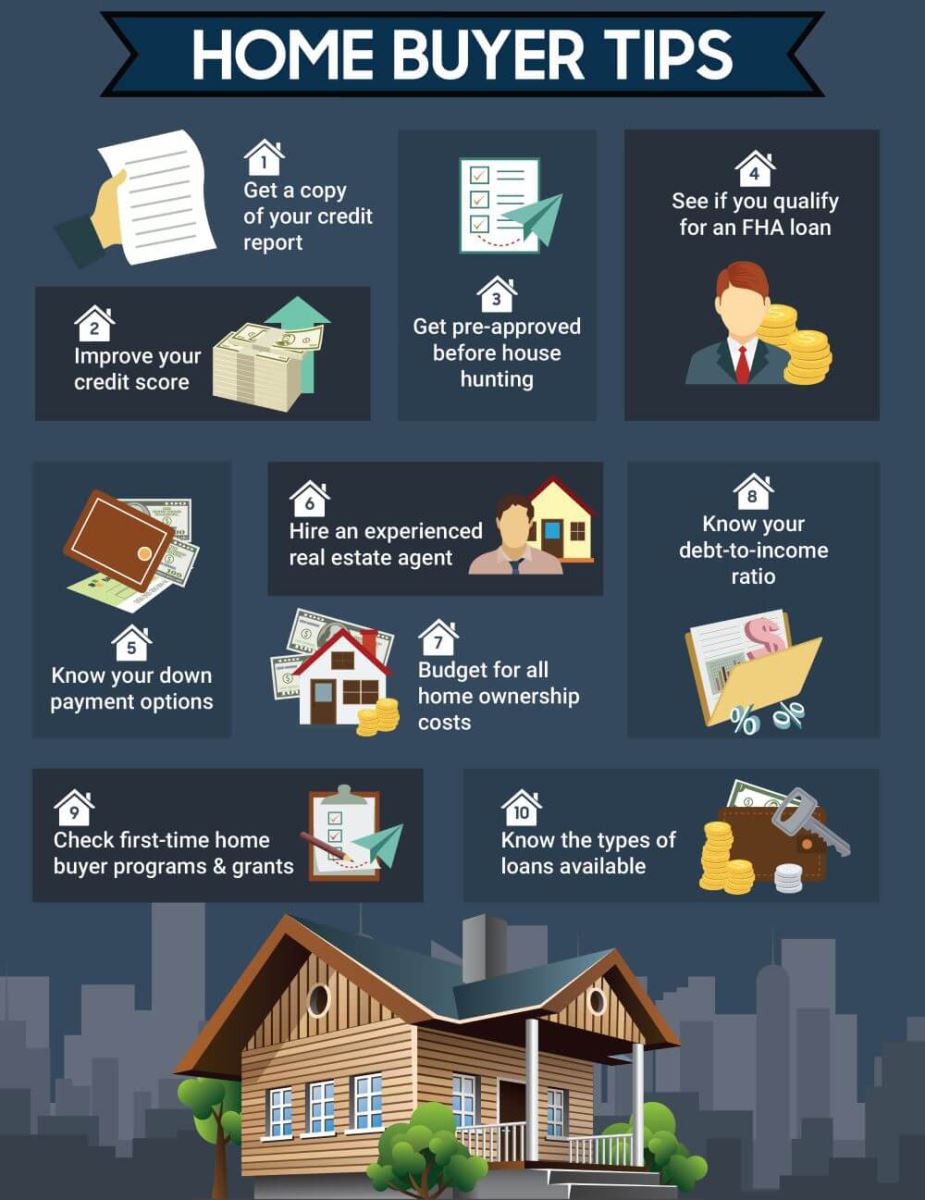

The FHA will insure loans for borrowers with scores as low as 500 but requires a 10% down payment for a score that low. Mortgage insurance is required for the life of an FHA loan and cannot be canceled. Saving a down payment is a huge burden for first-time home buyers. Conventional loans may require up to a 20% down payment (think $40,000 on a $200,000 home). If you’re a Colorado first time home buyer, CHFA can help you overcome this hurdle by offering free and low-cost funds to assist with the down payment and closing costs.

Douglas County Down Payment Assistance

First-time homebuyer assistance programs and/or grants were researched by the team at FHA.com. Please note that all programs listed on this website may involve a second mortgage with payments that are forgiven, deferred, or subsidized in some manner until resale of the mortgaged property. Grant programs for first-time homebuyers are available in Colorado cities and counties. These programs provide down payment and/or closing cost assistance in a variety of forms, including grants, zero-interest loans, and deferred payment loans. Minimum down payments are the lesser of $3,000 or 3% of the home’s purchase price.

FHA.com's compilation is not a complete list, but it can serve as a starting point in your search for the down payment assistance program or grant for your situation. It is up to the consumer to contact these entities and find out the specifics of each program. The Colorado Housing and Finance Authority offers eligible first-time homebuyer assistance through the CHFA Homeaccess program. Conventional Loans – Being self-employed does not automatically disqualify you from obtaining a conventional loan.

Give! Campaign 2022: Colorado Springs Children’s …

The earnings on those funds - interest and capital gains - are free from Colorado state taxes forever. In addition to our selection, the US Department of Housing and Urban Development provides a list of city- and county-specific programs across Colorado which you can see here. Meanwhile, if you sell, refinance, or trigger other conditions, you’ll have to repay your loan balance in full at that time. Denver’s Department of Housing Stability offers down payment assistance of up to $15,000. This seems to be part of the CHAC program, because interested parties are referred to it. In addition to down payment assistance, CHAC offers education courses and counseling.

While professionally managed HOAs make up about 80% of registered HOAs in Colorado, many communities prefer to self-manage the affairs of their association. This webresource page is designed to provide potential buyers in HOAs a view of matters that can be unique when buying in a self-managed HOA. Whether buying or selling a home, maneuvering through a real estate transaction can be a daunting task for many. It is not that often that an individual is involved in the real estate process during their lifetime.

Federal Supplemental Educational Opportunity Grant Fseog

If you’re a first-time buyer in Colorado with a 20% down payment, you can get a conventional loan — likely with a low interest rate and no private mortgage insurance . Most lenders use a debt-to-income ratio and do not like this ratio to exceed 43%, depending on the program. For example, let’s say that you bring in a gross paycheck of $4,000 monthly . Your total amount of debt, including the mortgage, credit card payments, and car payments is $1,750.

We are pledged to the letter and spirit of U.S. policy for the achievement of equal housing opportunity throughout the Nation. At Wells Group Durango, we assist our clients in accessing the NGOs or charitable organizations' house ownership programs. It all starts here by choosing a home and low down payment option that best fits your purchase plan.

All you will be expected to do is buy your home, show up at closing, and find your cash grant waiting. Be smart when it comes to your FHA loan and your financial future. A good FICO score is key to getting a good rate on your FHA home loan. — Its the question on everyone’s mind, how’s the current housing market doing Vs the previous one? Loving Living Local host Nova sat down with Colorado First Time Home Buyer realtor Christen Costin gave expert advice and guidance for any new home buyers. Can pair you with as many as three financial advisors in your area.

Remember, that’s only in Adams, Arapahoe, Denver, Douglas or Jefferson County. If that’s not enough, you can bump that up to 4% of your mortgage amount. But this is in the form of a second mortgage loan rather than a grant. Additionally, licensed professionals can find updates on licensing deadlines, opportunities for stakeholder engagement, and important practice guidance matters. With nearly 10,000 HOAs in Colorado, if you’re looking for a new home, there’s a good chance you’ll end up in one. Since most associations have restrictive covenants, your ability to do what you want with your own home may be curtailed.

Dont forget that buying a home also means paying moving and closing costs. When it comes to homeownership, there is more than just monthly mortgage payments. Make sure you factor in homeowners insurance, property taxes and upkeep. But requirements may vary from one program or organization to the next, and some programs use criteria other than credit scores to determine a borrowers eligibility. You can check with the organization or lender offering first-time homebuyer assistance to get specific financial requirements.

The way to get more information about each program, and apply, is described above. The FirstStep Plus no-payment, 0% interest second mortgage may be for up to 4% of the first mortgage amount. Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

And you have to pay back the entire amount when you sell the home, when it is no longer your primary residence, or when you refinance with cash out. You’d have to repay that loan in full when you sell, refinance, or finally pay off your first mortgage. Still, you don’t have to make any monthly payments in the meantime. CHFA down payment assistance grants provide up to 3% of your mortgage amount as a grant, which is money that never has to be repaid. These programs are often meant to help low-income home buyers, and many have income caps based on household size.

Once you pay 20% of your loan, mortgage insurance will be canceled, which will lower your mortgage payments. Fortunately, Colorado homebuyers may be able to get financial help through programs offered by the state and some cities and counties. There also are longstanding federal programs that could improve a buyer’s chances of success. The Downpayment Toward Equity Act awards up to $25,000 so renters can buy their first home. Grant monies can be used to make a down payment, pay for closing costs, lower your mortgage rate by using discount points, and cover other expenses, too. To apply to a specific program, youll have to work with a participating lender.

This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners. Finding a qualified financial advisor doesnt have to be hard. SmartAssets free tool matches you with up to three financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you. If youre ready to find an advisor who can help you achieve your financial goals, get started now. FHA.com is a privately-owned website that is not affiliated with the U.S. government.

Besides CHAC, you may also be able to get assistance from the Community Resources and Housing Development Corporation NeighborhoodLIFT program. This is available to buyers in Adams, Arapahoe, Denver, Douglas, and Jefferson Counties. The Colorado Housing Assistance Corporation is another official statewide body providing all sorts of advice, education, and assistance to any first-time homebuyer in Colorado who asks.

Comments

Post a Comment